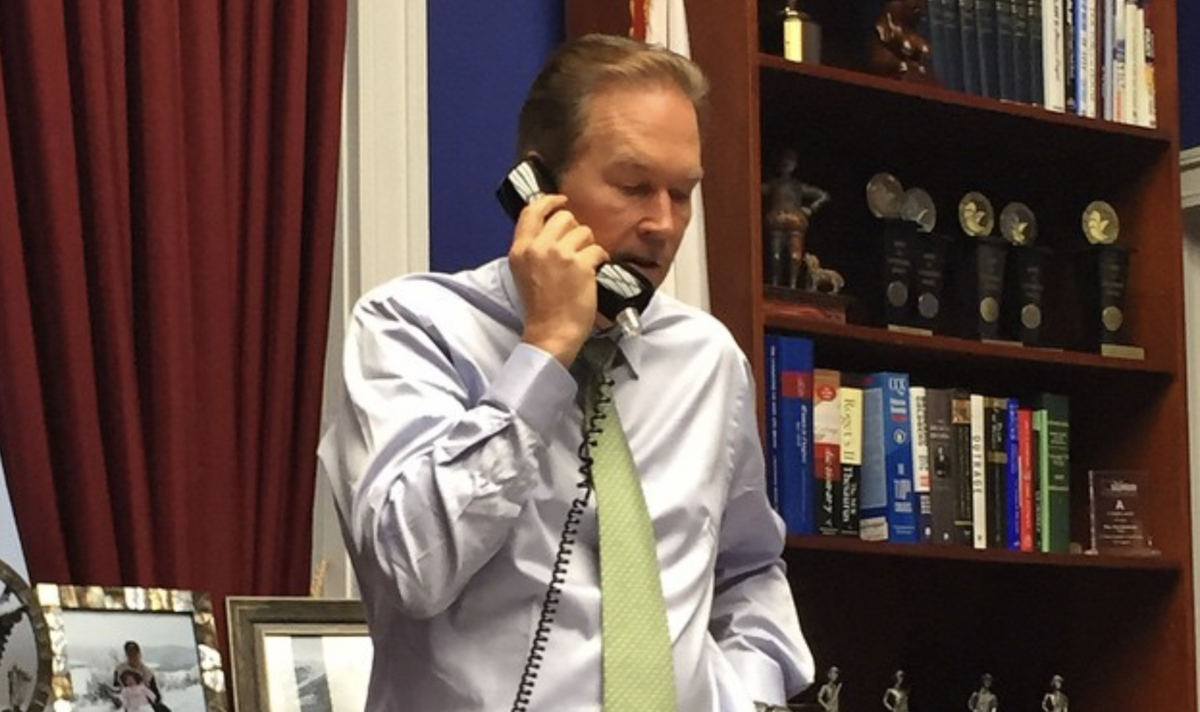

Representative Vern Buchanan (R-FL) introduced a bill increasing tax incentives for small businesses, encouraging growth and innovation.

The most significant provision of Rep. Buchanan's American Innovation Act is increasing the amount of income small businesses can deduct from federal income taxes from $5,000 to $20,000, a massive tax break.

Additionally, startup expenditure deductions, like advertising, employee salaries, rent, and office utilities, will be raised from $50,000 to $120,000, both tax breaks allowing small businesses to invest more capital back into their continued growth and innovation.

In his press release, Rep. Buchanan chastised the Biden administration's economic policies: "America's small businesses are still recovering from four years of Biden's overspending and runaway inflation."

As a result, he continued, "Helping entrepreneurs take their unique ideas from concept to reality will jumpstart our economy and give them a deserved shot at the American Dream. As Congress prepares to address historic tax legislation, we need to focus on making it easier for small businesses to do what they do best—create jobs, advance innovation, and invest back into our communities."

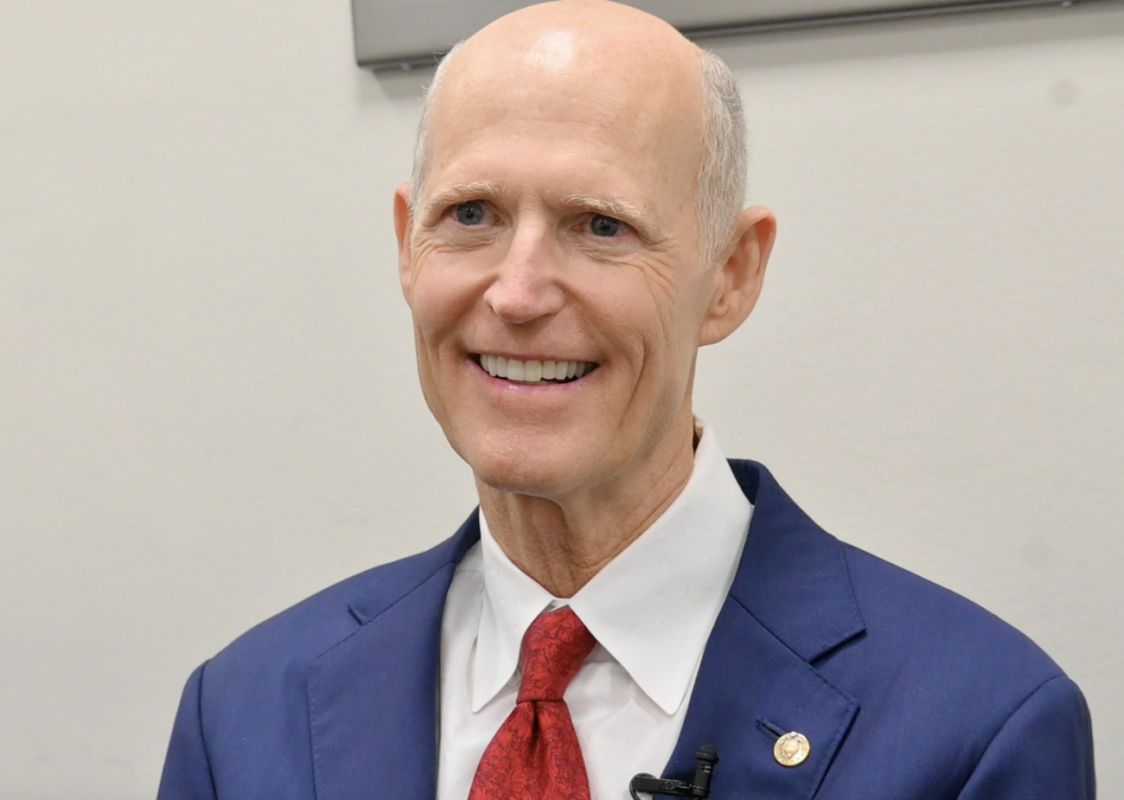

Similarly, Representative Mike Kelly (R-PA), the bill's cosponsor, said, "The American Innovation Act allows for investments in research and development to help small businesses grow and allow entrepreneurs to take that next step in their American Dream. This pro-growth tax policy will kickstart our small businesses, and it makes it easier for these businesses to create jobs, support families, and grow our local economies."

Last January, the House Ways and Means Committee passed the Tax Relief for American Families and Workers Act, which improves tax deductions for business equipment, extends research and development (R&D) expenses, expands the Child Tax Credit, and enhances the Low-Income Housing Tax Credit, making it easier for low-income people to afford a home.

The Florida Congressman applauded the bill's passage, saying, "As someone who spent 30 years building businesses, as well as a former chairman of the Ways and Means Tax Subcommittee, I know from experience that making our tax code more competitive means greater prosperity for American families and businesses."